2025 Inspiration Hub

According to the Climate Policy Initiative’s 2023 report on the Global Landscape of Climate Finance, the average annual climate finance flows for 2021/2022 reached $1.3 trillion, their highest level yet. However, the annual climate finance flows needed to avoid the worst effects of climate change are estimated to be $10 trillion. A major reason for this shortfall is the lack of profitability and bankability of climate adaptation and mitigation solutions. The CIC is providing a platform to do just that.

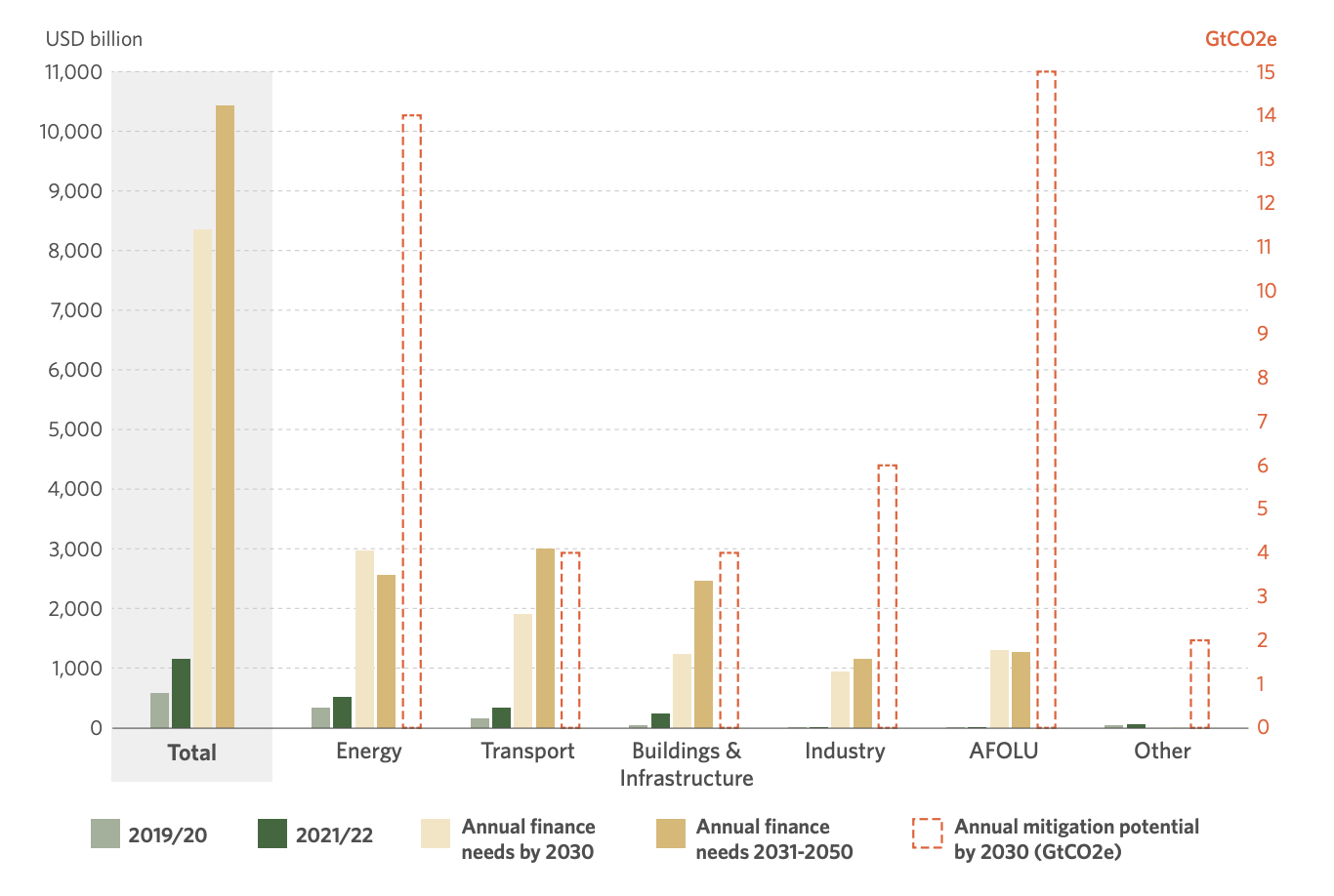

At the moment, 91% of global climate finance is routed to mitigation efforts. Within mitigation projects, energy and transport are the dominant investment areas. The below infographic by the Climate Policy Initiative shows the current climate finance flows towards various mitigation sectors, the needed flows, and the mitigation potential. This is a useful illustration to understand which sectors are currently underdeveloped in terms of solutions and financing.

Looking at the annual adaptation flows, the following infographic by the Climate Policy Initiative again shows an increase in the annual finance flows but the total still falls short of the expected adaptation finance needs in the near future.

Below, we share some themes as guidelines that can help get your thinking started on the mitigation and adaptation areas that require solutions and that need financing for those solutions:

Note: Applicants can choose to focus their application on any climate issue. They do not need to choose one of the below themes. These themes are solely to provide inspiration for those who do not currently have an idea. Applications that focus on any of the themes below will not be viewed more favourably.

Main Competition Prize

Built Environment is responsible for about 42% of global carbon dioxide emissions. Decarbonizing our cities is an urgent imperative. How can we finance less carbon-intensive ways of producing cement, concrete, and other materials to construct buildings? What technological solutions can help us reduce the carbon footprint of our urban areas? Are there any technologies that would enable insurance companies to insure buildings in climate-risk areas, such as coastal cities?

Energy Capacity Constraints from national grid networks are hampering private investment into renewable energy. What role can finance play in modernising national grid networks to facilitate green energy investment?

Decarbonatization of Hard to Abate Sectors: How might finance help to develop solutions in alternative fuels, testing, or finding sources of carbon to develop synthetic fuels, for example. This is key to global decarbonization, where the majority of emissions are going to remain, once other emission sources have been reduced.

Domestic energy saving: How can we accelerate investment into more sustainable domestic energy and storage solutions? What long-term financial planning tools can be shaped to encourage consumers to take a more long term investment in property modernizations and retrofits?

Emerging and Developing Markets Prize

Financing Resilient Infrastructure: Emerging markets are disproportionately vulnerable to climate impacts due to inadequate infrastructure. Resilient infrastructure projects are crucial for long-term sustainable positions and fostering economic growth. How can innovative financial structures, such as blended finance or green bonds, support the development of climate-resilient infrastructure in emerging markets? For instance, could we finance flood defenses for coastal cities, support renewable energy microgrids in off-grid areas, or build sustainable urban transport systems to attract private sector investment while delivering measurable climate adaptation and mitigation outcomes?

Natural Capital and Biodiversity: Emerging markets are rich in biodiversity, but the loss of natural capital due to deforestation, pollution, and overexploitation poses risks to their long-term economic stability. What financial mechanisms can be designed to protect and monetize natural capital while ensuring community benefits? For example, could Payment for Ecosystem Services programs fund forest preservation, biodiversity-linked bonds finance conservation efforts, or innovative insurance products protect critical ecosystems? How can we align economic incentives with nature preservation to unlock sustainable development potential?

Enabling Access to Clean Energy: Energy access remains a critical challenge in many emerging markets, with millions lacking reliable electricity. How can finance drive scalable, clean energy solutions for underserved populations in emerging markets? Could pay-as-you-go models provide affordable solar home systems, community-based financing fund renewable energy projects, or green bonds electrify rural schools and health centers? How can we expand access to clean, affordable energy and reduce reliance on fossil fuels?

Mitigating Financing Risks: Financing projects in emerging markets often involves heightened risks due to political instability, currency fluctuations, and limited market data. How can financial mechanisms and structures mitigate these risks while still enabling impactful investment? Could credit enhancement tools, such as guarantees or blended finance, reduce the perceived risk for investors? How can local partnerships and innovative risk-sharing models encourage private sector participation in financing sustainable development projects? What role can innovative financial instruments play in addressing these challenges while ensuring sustainable outcomes?

Data Analytics Prize

Sustainability-linked financial instruments: Financial instruments such as bonds or loans, where the repayment amount depends on the achievement (or not) of specific sustainability KPIs are powerful tools to align financial and sustainability incentives. How can we use these instruments to finance climate adaptation, climate mitigation or nature recovery? What novel datasets, models and technologies allow us to create new instruments in a cost-effective and transparent manner?

Nature-related financial risks: All companies are dependent on nature in one way or another. Additionally, companies’ activities have both a direct and indirect impact on nature and biodiversity. These cause nature-related financial risks that financial institutions are increasingly exposed to. How can we transform environmental datasets, for instance from in-situ sensors or satellites, into relevant nature risk metrics for financial institutions? Which technologies can we leverage to do this at scale?

Climate-related financial risks: Climate change poses significant financial risks through physical impacts such as extreme weather events and chronic changes (e.g., rising sea levels) and transition risks linked to shifts in policies, technologies, and market preferences. How can we harness climate datasets, such as emissions inventories or climate model projections, to develop robust metrics and tools that assess climate-related risks to financial institutions and investors? What innovative technologies and approaches can enable scalable, real-time risk analysis to guide financial decision-making?

Environmental markets: Markets for environmental assets, such as carbon credits, biodiversity offsets, and water rights, are expanding rapidly to support sustainability goals. However, these markets require reliable data and technology to ensure transparency, trust, and efficiency. How can we use environmental science and data to improve the measurement, verification, and pricing of environmental assets? What novel technologies, such as AI or blockchain, can enhance the functioning of these markets and unlock new opportunities for investors?